Gold Price Analysis: XAU/USD set to test 7-yr high

摘要:Gold Price Analysis: XAU/USD set to test 7-yr high

Gold looks to break Fridays range trade to the upside.

Falling trendline hurdle at $1776.60 is the level to beat for the bulls.

XAU/USD closed above all major hourly Simple Moving Averages (HMA).

Following consolidation in a $5 range on holiday-thinned Friday, Goldprices (XAU/USD) are poised for another leg higher after falling off the seven-year tops of $1789.28 last Wednesday.

With looming concerns over a surge in the coronavirus cases worldwide and economic recovery unlikely to wane, gold could likely continue drawing the haven bids in the near-tern.

Although the ongoing optimism on the global stocks could slowdown the yellow metals advances towards the $1800 mark.

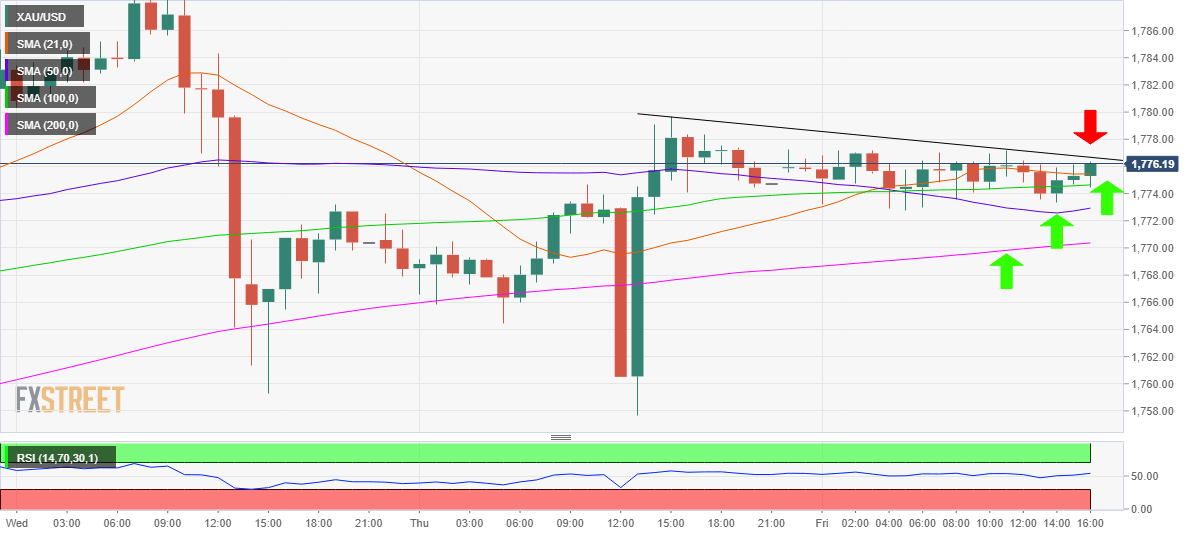

Technically, looking at the hourly chart, gold is set to break through the falling trendline resistance aligned at $1776.60, also where Fridays high converges.

Acceptance above the latter could see a test of the multi-year high. The hourly Relative Strength Index (RSI) points northwards at 56.05, hinting at more room for the upside.

Also, the fact that the price closed above the 21-HMA at $1775.45 adds credence to the near-term bullish outlook. Its worth noting that the XAU bulls have regained ground above all the major HMAs.

On the flip side, the immediate downside could be capped by the 21-HMA, below which the next support awaits at the horizontal 100-HMA at $1774.64.

Further south, the 50-HMA at $1772.93 is likely to offer some temporary reprieve to the bulls while the 200-HMA at $1770.36 is the level to beat for the bears in the coming days.

All in all, the path of least resistance appears to the upside amid a lack of healthy resistancelevels.

Gold: Hourly chart

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

澳储行将利率维持在 4.35% 不变,澳元/日元走强

澳储行行长布洛克:目前利率政策需要保持限制性政策

若哈里斯与特朗普在选举人团票数打平,将会发生什么?

金价持平于 2730 美元上方,焦点仍集中于美国总统大选

美国总统大选揭晓前市场维持谨慎情绪,美元/瑞郎仍遇阻0.8650

盈透证券10月份业绩强劲增长!

纽储行:经济形势依然严峻,企业面临困难

继采购经理人指数公布后澳元走强,焦点处在澳储行决议

特朗普交易全面爆发

受特朗普交易增长影响,纽元/美元下跌超过1%

汇率计算