Rising Debts May Cause Depreciation of US Dollar

摘要:Jeffrey Gundlach, the CEO of DoubleLine Capital nicknamed “King of Bonds”, said he is expecting US dollar to go weak. He pointed out that due to US dollar’s relevance to the “twin deficits” of US in current account and budgets, the currency will likely drop in price.

Jeffrey Gundlach, the CEO of DoubleLine Capital nicknamed “King of Bonds”, said he is expecting US dollar to go weak. He pointed out that due to US dollars relevance to the “twin deficits” of US in current account and budgets, the currency will likely drop in price. “As foreign investors withdraw their capital, which I think will be a main trend in several years to come, the US dollar may significantly depreciate, starting from this year.”

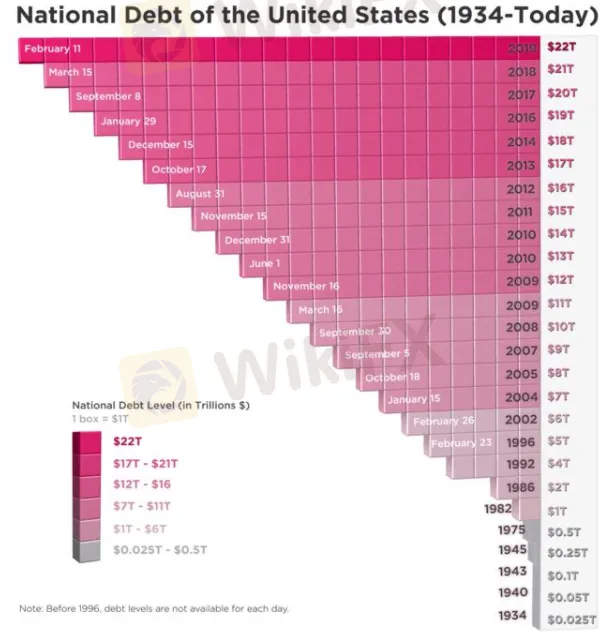

With a spending larger than income, US budget deficit for the first 3 months in fiscal year 2020 has expanded to US$356.6 billion, and if the trend continues, the Federal government‘s deficit may exceed US$1 trillion by the end of this year, which will be the highest since the financial crisis. Gundlach’s DoubleLine Capital manages approximately US$150 billion of assets, and he has been warning about decline of USD since January, 2018. Should his prophecy come true, Gundlach expects the price of gold and other commodities will benefit.

He also said the predictive indicators signaling economic recession are “flashing yellow”, pointing out that theres a 30%-35% likelihood for US economy to decline in the 2020. If PMI and consumer confidence index go low while unemployment increases, chance for a recession will be even bigger.

He also estimate that emerging markets will perform well this year, so investors should seek to purchase stock and bonds from these areas. As for political outlook, Gundlach thinks the greatest uncertainty facing US financial market will be Liberal Partys candidate for the presidential election, Bernard Sanders, as he sees the independent senate from Vermont to be the most promising in representing the Liberal Party in the 2020 presidential election.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

相关阅读

天眼交易商

热点资讯

美元走强,美元/加元上涨至1.3950上方

受地缘政治紧张局势影响,金价升至近两周高点,目标2700美元

美元/加元价格预测:处在1.3900中档关键水平上方,多头占主导

美国采购经理人指数来袭,美元/瑞郎下跌至0.8850附近

比特币、以太坊、瑞波币预测:比特币接近10万美元,美国证券交易委员会主席根斯勒递交辞呈

今日印度黄金价格:FXStreet数据显示,金价上涨

早盘简报:俄乌战争升级导致原油价格上涨

FCA监管曝光:警惕假冒艾迪迈诈骗

盈利大吉?等着你的,也许还有一份放弃利润劝退协议!

土耳其里拉:意外鸽派 - 德国商业银行

汇率计算